A Year of Radial Change: SVB 2023 Wine Industry Report Takeaways & Analysis

The State of the US Wine Industry 2023 report published by Rob McMillan of Silicon Valley Bank Wine Division provided a sobering perspective (pun intended!) for the future of wine. In his most blunt and cautionary report yet, McMillian outlines the challenges ahead balanced with notes of optimism and opportunity.

After reading all 96 pages, it is clear the industry has reached a vital fork in the road. We can continue what we’ve always done leading to a downward spiral, or we can innovate and grow. Many readers will find his analysis depressing. Yet, I have never been more excited or bullish about the future.

My analysis of the report is directed at the 90% of the industry that is its lifeblood: the small and medium privately owned wineries. The large corporate mass-producers have their own set of challenges ahead.

2022 Was A Good Year For The Wine Industry

Behind the doom and gloom of the report, it’s easy to lose sight of the key fact that 2022 was a very good year for the majority of the industry. McMillan states that:

“Small winery performance was solid in 2022 for the small premium wineries who dominate the index. In fact, 40 percent of owners responded that 2022 was one of their better years or their best year yet.”

My anecdotal discussions with clients and wine industry executives concurs with this: many brands saw tremendous success. Remy Sabiani, founder of DTC analytics platform WinePulse, is likewise optimistic after 2022. Overall, wineries using his platform saw 6% growth in their DTC channel. He notes that wineries that value data and analytics by nature are more progressive in their sales and marketing strategy. Therefore, it’s possible his winery clients are above-average brands. The correlation is notable. Wineries that rely on data and analytics did well last year and saw promising growth.

Channel wide growth is positive, but Sabiani also called attention to some “worrisome trends” he has observed from the industry. These trends include declining wine order and wine club conversion rates in the tasting room. He notes club membership is flat overall and an increase in attrition. Yet, with these declining trends, wineries made up the growth in other channels.

We must accept competing truths. 2022 was a growth year, and it is worth celebrating. Status quo is not a strategy you can bank on.

Market Forces Affect On Wine

Recession, what recession? Wine is not immune from economic principles and cycles. The impending recession economics have cautioned against has yet to materialize, but McMillian is not worried. He argues that,

“We are in the best position than we’ve ever been to successfully negotiate a recession, should that actually emerge.”

He furthers his point by explaining that, “Even with the economy softer as of this writing in December 2022, the typical consumers of premium wine are sitting on more than a trillion dollars in COVID savings. Our customers have the capacity to use their savings and discretionary income to buy wine even in a soft economy.”

Supply and demand will also affect the future of wine and he notes that wineries with excess inventory heading into a possible recession will fare worse. Luckily smaller harvests in key regions like Napa Valley the past few years work in the wineries favor.

The supply by volume may not be an issue, but the total number of wine brands is. It’s a fact that the market is oversaturated with wine brands, a point we have been raising for years. McMillian agrees and states that, “By some estimates, 200,000 different wine brands exist in the US. Nobody knows the exact number, but can we just agree that the wine category is rather saturated and fragmented? It’s confusing. How is a consumer to decide which wine to purchase?”

The Demographic Shift Mirage

For years, McMillian and other industry executives have called attention to the impending demographic shift of wine buyers. They have suggested beginning the process of lessening reliance on Baby Boomers and focusing on Millennials.

Unfortunately, data cited in the report paints a bleak picture of these efforts. Referring to a lackluster shift in purchasing by generational cohorts, McMillan bluntly said,

“This is telling us that whatever we’ve collectively tried to do to engage with the younger consumer in the last decade hasn’t been good enough. In fact, if we are doing something, the results are getting worse, so you could argue that we should immediately stop doing it.”

I believe the lack of success is due to inauthentic tactics meant to exploit Millennials and Gen Z instead of meeting them where they are. I fear too many marketing strategies designed to attract younger generations are conceived in boardrooms by people 45-65 years old. The problem is they are guessing what works instead of letting members of these generations drive the innovation and strategy themselves.

McMillian nails this disconnect:

“Younger consumers don’t put much trust in the wealthy even if they want to be rich themselves. They are skeptical about inauthentic and opaque marketing, and most of the time they don’t care about your family’s name on the bottle unless it comes with a story that resonates with them. A story that starts with ‘I made my money doing…’ isn’t helping your brand today.”

He follows this up with what does work instead:

“Younger consumers are more interested in what’s in the bottle — where it comes from, how it’s grown, the ingredients and additives, how it can make their lives more fulfilling and how you as an organization try to the world better.”

You may read his analysis and want to throw up your arms and assume there is no hope for Millennials, but in fact there is. Too many headlines purport that younger generations are wasting money on avocado toast and expensive lattes; therefore, they have no money to spend on luxury goods like wine. McMillian easily refutes this claim with data, “Price isn’t keeping the younger consumer from buying luxury goods. As noted earlier, millennials and Gen Z are responsible for all of the growth in the luxury goods category in 2022. Those in the luxury goods business market and build their brand. They know how to connect with buyers, and how to improve the value in their product, while raising prices.”

This leads to the literal million dollar question, “How can I grow my wine business and attract a younger demographic?” McMillian and I share a similar philosophy on the solution. He suggests that, “If we really want to reach the millennial, we need to look at how other beverages are marketed successfully, including soda, energy drinks, hard seltzers and spirits. Then we need to repurpose those ideas for our own benefit.”

The solution is clear: “Consumers have to be curious about wine. That is a function of advertising and promotion, something we as an industry must improve upon.”

Better Marketing Is The Solution To Growing Wine Sales

I see too many wineries scared of changing marketing tactics and afraid to invest in digital advertising. They budget only a few thousand dollars, yet expect drastic business changing results. That math doesn't add up. A lack of advertising spend is a real cause of wine’s slow growth compared to other alcoholic beverage categories.

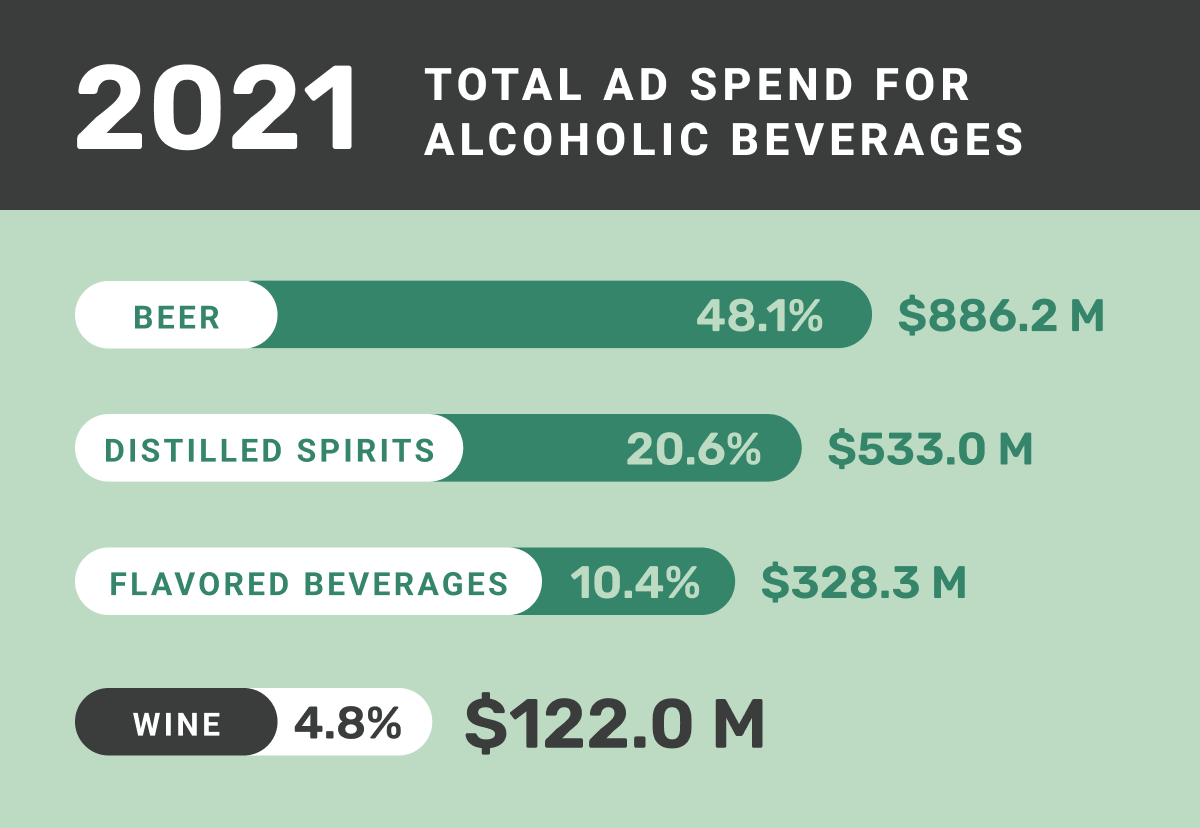

McMillian points out that wine advertising accounts for only “5 percent of all alcohol beverage advertising spending and…our category isn’t playing in the same league as beer, spirits or even flavored malt beverages when it comes to creating interest in the products. And it’s no coincidence that we are surrendering share to other beverage categories.”

Even if wineries committed to investing more in advertising, their messaging needs to change in order to be successful:

“What we are doing in the premium industry is selling white-linen hospitality and gracious living, with a nod to the lifestyles of the rich and famous in many cases — information that’s interesting to wine geeks and consumers over 60 but probably not to the vast majority of potential customers. That message is at best wasted on a younger crowd; at worst, it’s turning them off, as the data demonstrates.”

McMillian is 100% correct! He furthers his point explaining that, “It doesn’t matter if you are selling $10 chardonnay or $200 cabernet, the wine consumer is changing, and everyone needs to develop a strategy for their brand or risk riding the shrinking industry tide.”

Be Open To Radical Change

The report asks all of the right questions, but provides few answers on next steps. McMillian admits:

“The reality is that nobody has the perfect formula for selling wine to a consumer who has never tasted or heard of your brand. New customer and club member acquisition away from the tasting room is still in its infancy, so the solutions will evolve with new and reformed service providers and consultants and through wineries that experiment using different techniques (print, digital, phone, Zoom, etc.) to connect with remote consumers.”

Once again he nails it! The only way to grow is through innovation and change and it’s time for service providers and consultants to lead this change.

Change is hard. Few embrace it. McMillan warns that if the industry does not accept change, all ships will sink with the tide. He rightly calls out that,

“The growth opportunity for tomorrow means not doing what you’re already doing. Your winery needs to find new growth and new consumers, and they aren’t going to come from the present approaches.”

A Rallying Cry For The Ages

McMillan ends the report with a call to arms. He alludes to his longevity in the industry and the time for new leadership. He bluntly states that if we sit back and let continuing downward trends happen to us, the industry as a whole faces an uncertain future. He openly asks, “Will a young person in business school conclude, “I could do better than that!” and ends the report with three words in bold, “Who will lead?”

Our DTC wine marketing agency Highway 29 Creative has heard McMillan’s call and is ready to lead. We are as well positioned as ever to step up and steer the future of this industry. As a team of Millenials and Gen Z, our marketing tactics are unconventional and provocative in order to buck the status quo. While this may turn off the “business-as-usual” crowd in Napa Valley, it’s our biggest asset. The clients that trust our agency and understand us have seen the best results and biggest growth over the past five years.

As you digest this report and its implications, it’s your chance to make a decision. Are you open to the radical change necessary to build a sustainable growth trajectory in the wine business, or do you want to captain a sinking ship that is afraid to change course?

Those of you that choose the former, please reach out to us. We are excited to partner with like-minded companies ready to crush it

Simon Solis-Cohen is the founder of Highway 29 Creative, a leading digital and creative agency serving the wine industry. He challenges clients to think about the future and constantly innovate. The agency chases data, not fads, and provides one-stop shopping for wineries looking to enter or jolt their direct to consumer sales. Their approach starts by designing and building a website focused on conversion (wine sales, club sign ups & tasting room reservations) and then dives into each digital channel with consistent and effective content and messaging.